PROPOSAL 1.ELECTION OF DIRECTORS AND MANAGEMENT INFORMATION

Eight

Five directors,

are to be elected at the Annual Meeting, to hold office until the next annual meeting of shareholders

orand until their successors are elected and

qualified.qualified, are to be elected at the Annual Meeting. It is intended that the accompanying proxy will be voted in favor of the following persons to serve as directors unless the shareholder indicates to the contrary on the proxy. Management expects that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs,

it is intended that suchthe proxy

will be votedholders have authority to cast votes for the election of another nominee to be designated by the Board of Directors to fill any such vacancy.

The following persons have been nominated by the Company’s Board of Directors to be elected as directors at the Annual Meeting:

| | Age* | | Title |

| Min-Tan Yang | | 41 | | Chief Executive Officer and Director |

| Suang-Yi Pai | | 46 | | Chairman, Director and Acting Chief Finance Officer |

| Chin-Chen Huang | | 39 | | President of Shanghai Operations and Director |

| Ming-Tsung Shih | | 38 | | Director |

| Robert Theng | | 45 | | Director |

| | | | | |

Name | | * Age | | Title |

| |

| |

|

Kuo-An Wang | | | 44 | | | Chief Executive Officer, President and Director |

|

|

|

|

Yu-En Chiu | | | 43 | | | Chief Financial Officer, Secretary and Director |

|

|

|

|

Suang-Yi Pai | | | 43 | | | Director |

|

|

|

|

Chin-Chen Huang | | | 36 | | | Director |

|

|

|

|

Yu-Fang Lin | | | 27 | | | Director |

|

|

|

|

Ming-Tsung Shih | | | 37 | | | Director |

|

|

|

|

Yuanchau Liour | | | 50 | | | Director |

|

|

|

|

Robert Theng | | | 44 | | | Director |

as at December 31, 2006

2

Information about the NomineesKuo-An Wang

Min-Tan Yang was elected by the Board of Directors to fill an existing vacancy and appointed chief executive officer on November 2, 2005. He has a master’s degree from the Department of Business Administration of Da-Yeh University. Mr. Yang has served as Presidenta director of Shanghai Taiwan Businessmen Elementary School in China since January 2005 and a director of Global International Education Ltd since July 2001. In 2002 Mr. Yang was appointed as the Company since October 2002. From 1999chairman of two of the Company’s schools in Taiwan. Currently he is the chairman of four of the Company’s schools.

Suang-Yi Pai was elected to present,replace Mr. Kuo An Wang as the chairman of the board on November 2, 2005. Mr. Pai has served as President of Kid Castle Internet Technology. From 1997 to 1999, Mr. Wang was President of Kid Castle Enterprises Limited, Premier Holding Investment Property Ltd. and Global International Educational Investment Ltd.Yu-En Chiu has served as Chief Financial Officer, Secretary and a director of the Companycompany since October 2002. From 1999 to the present,Since 1998, Mr. ChiuPai has served as Chief Financial officer and Senior Vice Presidentthe general manager of Kid Castle Internet Technology. From 1997 to 1999, Mr. Chiu served as Vice PresidentChin Yi Fung Enterprises Co., Ltd., a privately held company engaged in the manufacture of Kid Castle Enterprises Limited.

Suang-Yi Paisandals.

Chin -Chen Huang has served as a director of the Company since October 2002. ForMrs. Huang has served as General Manager of Kid Castle Educational Software Development Company Limited from 1999 to the past five years through October 18, 2002, Mr. Paipresent. From 1997 to 1999, Mrs. Huang was an Assistant Manager of Kid Castle Enterprises. From 1999 to July 2005, Mrs. Huang has served as Senior Vice President of Kid Castle Internet Technology. From July 2005 to the present, Mrs. Huang has served as the GeneralPresident of Shanghai Operations.

Ming-Tsung Shih has served as a director of the Company since 2003. Mr. Shih is a lecturer at Tunghai University and has been the Financial Manager of Sunspring Metal Corporation, a company that manufactures and sells hydrant fittings, since November 2003. From 2002 to 2003, Mr. Shih served as the Financial Manager of Chin Yi Fung EnterpriseEnterprises Co., Ltd., a privately held company engaged in the manufacture of Velcro and Polyform products.Chin-Chen Huang has served as a director ofsandals. Prior to that, Mr. Shih was the Company since October 2002. From 1999 to the present, Mr. Huang has served as Vice President of Kid Castle Internet Technology. From 1997 to 1999, Mr. Huang served as an AssistantAudit Manager of Kid Castle Enterprises.

Yu Fang Lin has served as a director of the Company since October 2002. From 2001 to 2002, Ms. Lin served as a Specialist in Strategic Planning at Choice Lithograph, Inc., a publicly traded company in Taiwan engaged in the printing of books, magazines and calendars. From 1999 to 2000, Ms. Lin was a Programmer Analyst with American Management Systems, Inc. From 1998 to 1999, Ms. Lin was unemployed, and from 1997 to 1998 she completed her undergraduate education at the University of California, Berkeley.

Ming-Tsung Shih majored in accounting and graduated from Tunghai University in June 1990. He passed the CPA Examination in Taiwan in 1993, and received his Master of Business Administration in Accounting from National Chengchi University in June 1995. From 1995 to 2002 he worked at T N Soong & Co. (a, a member firm of Deloitte & Touche). Mr. Shih has also lectured at Tunghai University and worked as a financial manager and consultant for Chin-Yi-Fung Enterprise Co. Ltd and Sunspring Metal Corporation, respectively.

Yuanchau Liour is currently the Chairman of the Graduate Institute of Management Department of Marketing & Distribution and the Department of Business Administration. He is also a Principal at Nankong Community University in Taipei, Taiwan. Dr. Liour received his PhD in Business AdministrationTouche, from the University of Mississippi in 1989 and his Master of Business Administration from National Cheng-Chi University in 1981.

1995 to 2002.

Robert Theng is currently an associate professor of Graduate Institute of Management, Da-Yeh University and an adjunct professor of School of Business, Lawrence Technological University, USA and Walton College, Canada. Mr. Theng received his PHDPh.D. in Industrial Engineering, from Mississippi State University, USA in 1996 and his MasterMaster’s of Business Administration from Meinders School of Business, Oklahoma City University, USA in 1992. The directors named above will serve until the next annual meeting of the Company’s stockholders or until their successors are duly elected and qualified. The

These directors will be elected for one-year

terms.terms at the annual shareholders meeting. Officers will hold their positions at the pleasure of the Board of Directors, absent any employment agreement, of which none currently exists. There is no arrangement or understanding between any of the directors or officers of the Company and any other person pursuant to which any director or officer was or is to be selected as a director or officer, and there is no arrangement, plan or understanding as to whether non-management shareholders will exercise their voting rights to continue to elect the current directors to the Company’s

Board of Directors.board. There are also no arrangements, agreements or understandings between non-management shareholders that may directly or indirectly participate in or influence the management of the Company’s affairs.

None of the candidates is subject to (i) any material proceedings adverse to the registrant or any of its subsidiaries or has a material interest adverse to the registrant or any of its subsidiaries or (ii) any other legal proceeding.

The Board of Directors recommends that shareholders vote “FOR” the nominees named in this Proxy Statement. The eightfive individuals receiving the greatest number of votes shallwill be deemed elected even if they do not receive a majority vote.3

ADDITIONAL COMPANY INFORMATION

CORPORATE GOVERNANCE

Board Meetings

The Company’s Board of Directors has a standing Audit Committee which was established on April 7, 2004 by resolutionheld two meetings during 2006 and held two meetings with the Company’s auditors. During 2006, all directors attended at least 75 percent of the meetings of the Board of Directors. ForThe Company’s Bylaws provides that the 2003 fiscal year, the whole Board of Directors performedshould meet annually for the functionselection of the Audit Committee. Company’s officers and hold regular meetings.

Committees

The CompanyBoard of Directors does not have a standing audit committee, a standing nominating, or a compensation committees. Thecommittee. Instead, the whole Board of Directors performs the functions of athese committees. We do not have nominating committee and compensation committee. The memberscommittees because we feel that the entire Board of Directors can best perform this function

Following the resignation of Yuanchau Liour as a member of the Board of Directors and the then-standing Audit Committee, effective as of April 12, 2005, the Board of Directors assumed and served as the Audit Committee of the Company. In such role, the Board of Directors is responsible for the general oversight of the Company’s financial accounting and reporting, systems of internal control, audit process, and monitoring compliance with standards of business conduct and for discussing the functions performed thereby are described below:Audit Committee.Theaudited financial statements with the company. While the entire Board of Directors served as the Company's Audit Committee and assumed responsibility for reviewing the Company's financial statements with the Company's auditors during the fiscal year ended December 31, 2006, the two independent directors, Messrs. Shih and Theng, had separate reviewing sessions with the Company's auditors to discuss and ensure the accuracy and reliability of the Company's financial statements in addition to those sessions conducted with the full Board of Directors.

Audit Committee Financial Expert

Board Member Ming-Tsung Shih qualifies as an audit committee financial expert according to the standard set forth in Regulation S-K, Item 407. The entire Board of Directors serves as the Company’s Audit Committee.

Shareholder Communications with the Board of Directors

Shareholders may communicate with the Board of Directors by writing a letter to the Board of Directors. The letter should detail items so desired to bring to the attention of the Board of Directors, in the event that the Board of Directors deem a reply is comprisednecessary and appropriate, it shall reply to the return address and recipient as nominated in letter received from the shareholder. The shareholder’s letter shall be addressed to the Board of three independent members. At least one memberDirectors and be delivered by courier or registered post to Kid Castle Educational Corporation, 8th Floor, No. 98 Min Chuan Road, Hsien Tien, Taipei, Taiwan ROC. Attention should be directed to the Investor Relations officer, Ms. Lily Huang.

REPORT OF THE BOARD OF DIRECTORS ON FINANCIAL AUDIT OBLIGATION

The Board of Directors assumed and served as the Audit Committee must be a financial expert, as that term is defined for purposes of the listing standards contained inCompany and is responsible for the American Stock Exchange, Inc. Guide. The membersgeneral oversight of the Audit Committee are Ming-Tsung Shih (Financial Expert), Dr. Yuanchau LiourCompany’s financial accounting and Robert Theng. The Audit Committee reviewsreporting, systems of internal control, audit process, and recommends tomonitoring compliance with standards of business conduct. Management of the directors the independent auditors to be selected to audit theCompany has primary responsibility for preparing financial statements of the Company; meetsCompany as well as the Company’s financial reporting process. Brock, Schechter & Polakoff LLP, acting as independent auditors, is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles.

In this context, the Board of Directors hereby reports as follows:

(1) The Board of Directors have reviewed and discussed the audited financial statements for fiscal years 2005 and 2006 with the Company’s management and with the independent auditors and financial managementauditors.

(2) The Board of the Company to review the scope of the proposed audit procedures to be utilized; reviewsDirectors have discussed with the independent auditors the Company’s internal auditor,matters required to be discussed by Statement on Auditing Standards No. 61, Communications with Audit Committees.

(3) The Board of Directors has received the written disclosures and financialthe letter from the independent auditors required by Independence Standards Board No. 1, Independence Discussions with Audit Committees, and accounting personnel,has discussed with Brock, Schechter & Polakoff, LLP the internal accountingmatter of that firm’s independence.

(4) Based on the review and

financial controls of the company, and elicits any recommendations for the improvement thereof; reviews the financial statements of the Company and reports the results of the annual auditdiscussion referred to

in paragraphs (1) through (3) above, the Board of

Directors.4

Directors have approved that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 filed on March 8, 2007 and in the Company’s Annual Report on Form 10-K for the year ended December 31, 2006 filed on June 14, 2007 with the Securities and Exchange Commission.

The Board of Directors

Min-Tan Yang

Suang-Yi Pai

Chin-Chen Huang

Ming-Tsung Shih

Robert Theng

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of March 31, 2004,June 14, 2007, the number and percentage of our 18,999,703 25,000,000 outstanding shares of common stock that were beneficially owned by (i) each person who is currently a director, (ii) each executive officer, (iii) all current directors and executive officers as a group, and (iv)(v) each person who, to the knowledge of the Company is the beneficial owner of more than 5% of the outstanding common stock.| | | | | | | | | | |

| Name and Address | | Common Shares(1) | | Percent of Class |

| |

| |

|

| Kuo-An Wang | | | 1,728,000 | | | | 9.09 | % |

| | 8th Floor, No. 98 Min Chuan Road, | | | | | | | | |

| | Hsien Tien Taipei, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Yu-En Chiu | | | 1,296,000 | | | | 6.82 | % |

| | 8th Floor, No. 98 Min Chuan Road, | | | | | | | | |

| | Hsien Tien Taipei, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Suang-Yi Pai | | | 460,080 | | | | 2.42 | % |

| | No. 460-1, Chun Shan Road, Section 2, | | | | | | | | |

| | Hua-Tan Taipei, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Chin-Chen Huang | | | 350,600 | | | | 1.85 | % |

| | 8th Floor, No. 98 Min Chuan Road, | | | | | | | | |

| | Hsien Tien Taipei, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Kuo-Ian Cheng | | | 1,080,000 | | | | 5.68 | % |

| | No. 575, Ho Kang Road, Ho Mei Town | | | | | | | | |

| | Chang Hua Hsien, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Yu-Fang Lin | | | -0- | | | | 0 | % |

| | No. 71, Wenhua 1st Road, | | | | | | | | |

| | Gueishan Shiang Taoyuan, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Ming-Tsung, Shih | | | -0- | | | | 0 | % |

| | No. 29 Yongdong Street | | | | | | | | |

| | Yushun Villiage, Lukang Township | | | | | | | | |

| | Chang Hua, Taiwan, R.O.C | | | | | | | | |

|

|

|

|

| Dr. Yuanchau Liour | | | -0- | | | | 0 | % |

| | 8th Fl. 326 Sec. 6 Ming-Chuan E. Rd. | | | | | | | | |

| | Neihu, Taipei, Taiwan, R.O.C. | | | | | | | | |

|

|

|

|

| Robert Theng | | | -0- | | | | 0 | % |

| | 3 Ally 21 Ln 36 Chieh Shou S. Rd. | | | | | | | | |

| | Changhua 500, Taiwan, R.O.C. | | | | | | | | |

|

|

|

|

| All officers and directors as a Group (9 persons) | | | 3,834,680 | | | | 20.18 | % |

Name and Address of Beneficial Owner(1) | | Number of Shares | | Percent of Class(2) | |

| Suang-Yi Pai / 8th Floor, No. 98 Min Chuan Road, Hsien Tien Taipei, Taiwan, R.O.C . | | | 4,841,377 | | | 19.37 | % |

| | | | | | | | |

| Min-Tang Yang / 8th Floor, No. 98 Min Chuan Road, Hsien Tien Taipei, Taiwan, R.O.C | | | 9,165,538 | | | 36.66 | % |

| | | | | | | | |

| Chin-Chen Huang / 8th Floor, No. 98 Min Chuan Road, Hsien Tien Taipei, Taiwan, R.O.C | | | 5,000 | | | 0.02 | % |

| | | | | | | | |

| Ming-Tsung, Shih / No. 29 Yongdong Street Yushun Villiage, Lukang Township Chang Hua, Taiwan, R.O.C | | | - | | | - | |

| | | | | | | | |

| Robert Theng / 3 Ally 21 Ln 36 Chieh Shou S. Rd. Changhua 500, Taiwan, R.O.C. | | | - | | | - | |

| | | | | | | | |

| All officers and directors as a Group (5 persons) | | | 14,011,915 | | | 56.05 | % |

| |

| (1) | Unless otherwise indicated, the personsaddress of each person listed above have sole voting and investment powers with respect to all such shares. Underis 8th Floor, No. 98 Min Chuan Road, Hsien Tien, Taipei, Taiwan, Republic of China. |

| (2) | Based on 25,000,000 shares of common stock outstanding as of June 14, 2007. |

Section 16(A) Beneficial Ownership Reporting Compliance Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2006, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In late 2005, our company experienced financial difficulties and was incapable of generating cash flows sufficient to sustain our operations. At the time, our Board of Directors approached Messrs. Pai and Yang for financial aid and management support. Mr. Pai, a director of the Company, was elected Chairman on November 2, 2005 and subsequently procured short-term loans for the Company from two third parties, Olympic Well International Ltd. (“Olympic”) and Chen-Chen Shih , payable in three months in the amount of approximately U.S.$690,000 and $60,000 respectively, with a 7% annual interest rate. Mr. Yang, who was elected as a director of the Company on November 2, 2005, loaned us approximately U.S. $1.05 million with a 7% annual interest rate. As of July 31, 2006, the remaining debt owed by the Company to Olympic and Shih was assigned to Mr. Pai pursuant to Assignment Agreements dated as of August 1, 2006. On December 28, 2006, pursuant to the loan settlement and conversion agreement, the parties agreed to convert a portion of the loans to stock at a conversion price of $0.15 per share and to issue promissory notes for the remaining amount. The promissory notes are due in one year and have an annual interest rate of 7%. These transactions are summarized in the following table:

| | | Outstanding Principal as of 12/28/2006 (US$) | | Amount of Residual Promissory Note (US$) | | Promissory Note Due Date | | Promissory Note Interest Rate | | Principal converted to Common Stock (US$0.15/ share) | | Shares of Common Stock | |

| Pai | | | 407,725 | | | 107,680 | | | 12/27/2007 | | | 7 | % | | 300,045 | | | 2,000,297 | |

| Yang | | | 840,789 | | | 240,789 | | | 12/27/2007 | | | 7 | % | | 600,000 | | | 4,000,000 | |

Change in Control

Although there is no agreement, written or informal, between Messrs. Pai and Yang to act in concert with respect to exercising ownership of their shares of our stock, Messrs Pai and Yang may be considered a “syndicate, or other group for the purpose of acquiring, holding, or disposing of securities of an issuer” within the meaning of Section 13(d)(3) of the Exchange Act. Messrs. Pai and Yang may be deemed to have indirect control or shared voting power of stock held by their immediate family members. Mr. Pai’s wife and children hold a total of 1,574,040 shares of our stock, and Mr. Yang’s wife holds 500,000 shares. Consequently, the issuance of stock to Messrs. Pai and Yang as described may constitute a change in control of the Company. Messrs. Pai and Yang’s combined ownership of the outstanding stock of the company, when combined with stock held by their immediate family members, increased from 42.11% before the conversion described in Item 1.01 to 56.05% following the conversion. For further detail please see the Company’s report on Form 8-K/A filed with the SEC on January 24, 2007.

Policies and Procedures for Related Party Transactions

The Company recognizes that Related Person Transactions (defined as transactions, arrangements or relationships in which the Company was, is or will be a participant and the amount involved exceeds $10,000, and in which any Related Person (defined below) had, has or will have a direct or indirect interest) may raise questions among shareholders as to whether those transactions are consistent with the best interests of the Company and its shareholders. It is the Company’s policy to enter into or ratify Related Person Transactions only when the Board of Directors determines that the Related Person Transaction in question is in, or is not inconsistent with, the best interests of the Company and its shareholders, including but not limited to situations where the Company may obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from alternative sources or when the Company provides products or services to Related Persons on an arm’s length basis on terms comparable to those provided to unrelated third parties or on terms comparable to those provided to employees generally.

“Related Person” is defined as follows:

| 1. | any person who is, or at any time since the applicable rulesbeginning of the Securities and Exchange Commission,Company’s last fiscal year was, a director or executive officer of the Company or a nominee to become a director of the Company; |

| 2. | any person who is deemedknown to be the “beneficial owner”beneficial owner of a security with regard to which the person, directly or indirectly, has or shares (a) the voting power, which includes the power to vote or direct the votingmore than 5% of any class of the security, or (b) the investment power, which includes the power to dispose or direct the disposition,Company’s voting securities; |

| 3. | any immediate family member of any of the security, in each case irrespectiveforegoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the person’s economic interestdirector, executive officer, nominee or more than 5% beneficial owner, and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than 5% beneficial owner; and |

| 4. | any firm, corporation or other entity in which any of the security. Under SEC rules,foregoing persons is employed or is a person is deemed to beneficially own securities that thegeneral partner or principal or in a similar position or in which such person has the right to acquire within 60 days (x) through the exercise of any optiona 5% or warrant or (y) through the conversion of another security.greater beneficial ownership interest. |

5

Directors and executive officers are required to submit to the Board of Directors, acting in its role as audit committee, a list of immediate family members and a description of any current or proposed Related Person Transactions on an annual basis and provide updates during the year.

In its review of any Related Person Transactions, the Board of Directors must consider all of the relevant facts and circumstances available to it, including (if applicable) but not limited to: the benefits to the Company; the impact on a director’s independence in the event the Related Person is a director, an immediately family member of a director or an entity in which a director is a partner, shareholder or executive officer; the availability of other sources for comparable products or services; the terms of the transaction; and the terms available to unrelated third parties or to employees generally. No member of the Board of Directors may participate in any review, consideration or approval of any Related Person Transaction with respect to which such member or any of his or her immediate family members is the Related Person. The Board of Directors will approve or ratify only those Related Person Transactions that are in, or are not inconsistent with, the best interests of the Company and its shareholders, as the Board of Directors determines in good faith. The Board of Directors will convey the decision to the Chief Executive Officer or the Chief Financial Officer, who will convey the decision to the appropriate persons within the Company.

Director Independence

Based on the definition of “independent director” contained American Stock Exchange, Inc. Company Guide, which is the standard the Company has chosen to report under, Messrs. Shih and Theng are “independent directors.”

Compensation Discussion and Analysis

Compensation Committee Interlocks and Insider Participation

As the Company does not have a Compensation Committee, it has implemented the following procedures to determine the Company's executive compensation program. Compensation for the CEO and the CFO has been approved by the Independent Directors of the Board. Compensation for other executive officers and senior management is determined by the CEO or CFO pursuant to the Board of Directors delegating to the CEO and CFO authority to do so. None of our executive officers serve as members of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors.

In light of the financial distress of the Company in 2005, the Company's CEO, Mr. Yang, and CFO, Mr. Pai, volunteered to receive nominal salary from the Company. Since January 2006, Messrs Yang and Pai have been receiving annual base salaries in the amounts of $18,509 and $18,190, respectively, which were substantially lower than the compensation paid to executives in similar positions at peer companies.

Elements to Executive Compensation

The Company’s executive compensation program is designed to attract and retain executives responsible for the Company’s long-term success, to reward executives for achieving both financial and strategic company goals and to provide a compensation package that recognizes individual contributions as well as overall business results. The Company’s executive compensation program also takes into account the compensation practices of companies with whom Kid Castle competes for executive talent.

The two components of the Company’s executive compensation program are base salary and annual discretionary bonuses. Overall compensation is intended to be competitive for comparable positions at peer companies.

Objectives. The objectives of the Company's executive compensation policies are to attract and retain highly qualified executives by designing the total compensation package to motivate executives to provide excellent leadership and achieve Company goals; to align the interests of executives, employees, and stockholders by establishing cohesive management, financial, operation and marketing goals that reflect the Company's strategic growth plan; and to provide executives with reasonable security, through retirement plans and annual discretionary bonuses that motivate them to continue employment with the Company and achieve goals that will make the Company thrive and remain competitive in the long run.

Linkage between compensation programs and Company objective and values. We link executive compensation closely with the Company objectives, which we believe are dependent on the level of employee engagement, operational excellence, cost management and profitability achieved. Currently, the primary quantifiable measurement of operational excellence for the Company is the achievement of profitability, which is directly related to increasing annual revenue. Executives' annual performance evaluations are based in part on their achievement of the aforementioned goals and in part on revenue targets that may be established by the Board of Directors at the beginning of each fiscal year. The Company currently does not have a defined non-equity incentive plan in place for its named executives. Instead, the disinterested members of the Board of Directors determines if any annual discretionary bonuses should be awarded to named executives in conjunction with the named executives’ annual performance evaluations. As indicated in the table below, during the last three fiscal years, the Board of Directors has not elected to award any annual discretionary bonuses to any named executives.

The roles of various elements of compensation. Executive compensation includes base salary, annual discretionary bonuses awarded by the Board of Directors in conjunction with named executives’ annual performance evaluations and other annual compensation granted under the non-contributory defined benefit retirement plan. Collectively, the Board's objective is to ensure a total pay package that is appropriate given the performance of both the Company and the individual named executive.

Governance practices concerning compensation. The Board of Directors has implemented a number of procedures that the Board follows to ensure good governance. These include setting CEO and CFO salaries, authorizing the CEO or the CFO to set the salaries of presidents and vice presidents, including Mrs. Huang, President of Shanghai Operations, setting annual goals for the Company, reviewing proposals for stock incentive plans, exercising fiduciary responsibilities over retirement plans, overseeing management development and succession planning, and keeping adequate records of its activities.

Base Salary

Each named executive’s base salary is initially determined with reference to competitive pay practices of peer companies (where such information is publicly available) and is dependent upon the executive’s level of responsibility and experience. The Board of Directors uses its discretion, rather than a formal weighting system, to evaluate these factors and to determine individual base salary levels. Thereafter, base salaries are reviewed periodically and increases are made based on the Board of Director’s subjective assessment of individual performance, as well as the factors discussed above. In light of the financial distress of the Company in 2005, Mr. Pai and Yang volunteered to receive no salary payments from the Company. In 2006, Mr. Pai and Mr. Yang were awarded $18,190 and $18,509 annual salary packages, respectively.

To ensure that its overall compensation is competitive, the Company reviews executive compensation, including both base salary and variable compensation, with a range of peer companies that offer tuition services in the children education industry and have physical presence in the PRC and ROC regions. The data gathered on these business entities is publicly available information from industry specific resources and the World Wide Web. Please note, however, that the many of the Company’s peers are not publicly-traded companies and, as a result, only limited information regarding executive compensation is available. The English-language teaching and educational services industry in Asia is highly fragmented, varying significantly among different geographic locations and types of consumers. Our main competitors in Taiwan include Giraffe Language School, Joy Enterprise Organization, Jordan's Language School, Gram English, Sesame English Franchised Schools, Ha Po Computer English School and Hess Educational Organization. Our main competitors in the People's Republic of China include English First, New Oriental Educational & Technology Group, DD Dragon Education Organization and Only Education Group. More information regarding our main competitors in the PRC and ROC regions can be found in our annual report on Form 10-K for the fiscal year ending December 31, 2006, as filed with the Securities and Exchange Commission on June 14, 2007.

Based on its review of the information available, our Board of Directors determined that the range of salaries for Chief Executive Officers is $90,000 to 144,000 annually.

Annual Discretionary Bonuses

In past years the company has paid annual discretionary bonuses to its executives, however, due to the Company’s overall performance in 2004, 2005 and 2006, the Company’s executive officers were not awarded bonuses.

Summary Compensation Table The following table sets forth information

for the fiscal years ended December 31, 2003 and December 31, 2002 concerningabout the compensation paid

or accrued by the Company to the Company’s chief executive officer and

awarded to all individuals serving as ourthe three most highly compensated executive officers,

at December 31, 2003 and thoseor named officers,

or key employees who were employed duringfor the

year ended December 31, 2003 whose total annual salary and bonus during that year exceeded $100,000:| | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Annual Compensation | | |

| | | |

| | All Other |

| Name and Principal Position | | Year | | Salary($) | | Bonus($) | | Compensation($) |

| |

| |

| |

| |

|

| Kuo-An Wang, | | | 2003 | | | $ | 97,561 | | | $ | 8,130 | | | $ | 15,086 | |

Chief Executive Officer and President | | | 2002 | (1) | | $ | 85,797 | | | $ | 4,020 | (2) | | $ | 19,013 | (3) |

|

|

|

|

| Yu-En Chiu, | | | 2003 | | | $ | 76,655 | | | $ | 6,388 | | | $ | 10,778 | |

Chief Financial Officer and Secretary | | | 2002 | | | $ | 69,575 | (4) | | $ | 3,167 | (5) | | $ | 14,818 | (6) |

|

|

|

|

| Chin-Chen Huang, | | | 2003 | | | $ | 55,261 | | | $ | 2,177 | | | $ | 8,392 | |

Senior Vice President of the Group | | | 2002 | | | $ | 43,277 | (7) | | $ | 0 | (8) | | $ | 746 | (9) |

last three completed fiscal years:

SUMMARY COMPENSATION TABLE |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) | |

Min-Tan Yang Chief Executive Officer | | | 2006 2005 2004 | | | 18,509 - - | | | - - - | | | - - - | | | - - - | | | - - - | | | - - - | | | - - - | | | 18,509 - - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Suang-Yi Pai Chief Financial Officer and Secretary | | | 2006 2005 2004 | | | 18,190 - - | | | - - - | | | - - - | | | - - - | | | - - - | | | - - - | | | - - - | | | 18,190 - - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Chin-Chen Huang President of Shanghai Operation | | | 2006 2005 2004 | | | 70,565 59,129 63,077 | | | - - - | | | - - - | | | - - - | | | - - - | | | - - - | | | 3,746 5,505 4,164 | (i)(ii) | | 74,311 64,634 67,241 | |

| (i) | | |

| (1) | Mr. Wang became CEO and PresidentEstimated annual retirement benefits of Mrs. Huang under the Company on October 1, 2002. |

|

| (2) | IncludesCompany’s non-contributory defined benefit retirement plan, includes health, accident, and labor insurance premiums in the aggregate amount of $1,293 and$2,160, accrued retirement benefits under the Company’s non-contributory defined benefit retirement plan in the amount of $2,284.$1,586. |

|

| (3) (ii) | Estimated annual retirement benefits of Mr. WangMrs. Huang under the Company’s non-contributory defined benefit retirement plan. |

|

| (4) | Mr. Chiu became CFO and Secretary of the Company on October 1, 2002. |

|

| (5) | Includesplan, includes health, accident, and labor insurance premiums in the aggregate amount of $2,272 and$3,582, accrued retirement benefits under the Company’s non-contributory defined benefit retirement plan in the amount of $1,794. |

|

| (6) | Estimated annual retirement benefits of Mr. Chiu under the Company’s non-contributory defined benefit retirement plan. |

|

| (7) | Mrs. Huang became the Vice President, Secretary, and a Director of the Company on October 1, 2002. |

|

| (8) | Includes health, accident and labor insurance premiums in the aggregate amount of $2,091 and accrued retirement benefits under the Company’s non-contributory defined benefit retirement plan in the amount of $1,014. |

|

| (9) | Estimated annual retirement benefits of Mrs. Huang under the Company’s non-contributory defined benefit retirement plan.$1,923. |

Stock Option Grants Inin the Last Fiscal Year; Exercises of Stock Options

There were no grants of stock options during the fiscal year ended December 31, 2006. The Company has never granted any stock options.

Pension Plans

The Group maintains tax-qualified defined contribution and benefit retirement plan for its employees in accordance with ROC Labor Standard Law. As a result, the Group currently maintains two different retirement plans with contribution and benefit calculation formulas. On July 1, 2005, the Bureau of National Health Insurance issued New Labor Retirement pension regulations in Taiwan. The Group has defined the new contribution retirement plan (the ‘New Plan”) covering all regular employees in KCIT, and KCIT contributes monthly an amount equal to 6% of its employees’ basic salaries and wages to the Bureau of National Health Insurance. The Group still maintains the benefit retirement plan (the “Old Plan”), which commenced in September 2003 and only applies to the employees of KCIT who were employed before June 30, 2005, and KCIT contributes monthly an amount equal to 2% of its employees’ total salaries and wages to an independent retirement trust fund deposited with the Central Trust of China in accordance with the ROC Labor Standards Law in Taiwan. The retirement fund is not included in the Group’s financial statements. Net periodic pension cost is based on annual actuarial valuations which use the projected unit credit cost method of calculation and is charged to the consolidated statement of operations on a systematic basis over the average remaining service lives of current employees. Contribution amounts are determined in accordance with the advice of professionally qualified actuaries in Taiwan. Under the plan, the employees are entitled to receive retirement benefits upon retirement in the manner stipulated by the relevant labor laws in Taiwan. The benefits under the plan are based on various factors such as years of service and the final base salary preceding retirement.

| Name | | Plan Name (i) | | Number of Years Credited Service (#) | | Present Value of Accumulated Benefit ($) | | Payments During Last Fiscal Year ($) | |

| CEO/PEO-Min-Tan Yang | | | - | | | - | | | - | | | - | |

CFO/PFO Suang-Yi Pai | | | - | | | - | | | - | | | - | |

President of Shanghai Operations Chin-Chen Huang | | | Old and New (i) | | | 4 | | | 84,125 | | | 1,586 | |

| (i) | Former retirement plan ("Old Plan") calculation of pension benefits is applied prior to July 1, 2005 and existing retirement plan ("New Plan") calculation of pension benefits is applied after July 1, 2005. |

Compensation Committee Report

As we do not have a compensation committee, the entire board of

Directorsdirectors reviewed and discussed the Compensation Discussion and Analysis set forth above and agrees to its inclusion in this annual report on form 10-K.

| Suang-Yi Pai |

| Min-Tan Yang |

| Chin-Chen Huang |

| Ming-Tsung Shih |

| Robert Theng |

Director Compensation

The Company’s Bylaws provide that the Company’s directors may be paid their expenses and a fixed sum for attendance at meetings of the Board of Directors,

and may be paid a stated salary as a director, and no such payment shall preclude any director from serving the Company in any other capacity and receiving compensation

therefor.therefore. Currently, each independent director is paid

US$615(NT$20,000

) for his attendance at each regular Board meeting.

6

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On October 23, 2001, the Company entered into a loan agreement with Kuo-An Wang, our Chief Executive Officer, in the principal amount of 5,000,000 NTD (approximately US$153,846). The loan was unsecured, bore interest at 6% per annum and had no fixed repayment terms. Mr. Wang repaid the full amount of the loan to the Company on June 30, 2003.

For the years ending December 31, 2003 and 2002, there were a number of related party transactions between affiliated companies. These transactions are more particularly described in Note 19 to the Company’s financial statements contained in the Company’s Annual Report on Form 10-KSB for the year ended December 31, 2003.

PROPOSAL 2.

RATIFICATION OF SELECTION OF AUDITORS

The Board of Directors will request that the shareholders ratify its selection of PricewaterhouseCoopers LLP, independent auditors, to examine the consolidated financial statements of Kid Castle for the fiscal year ending December 31, 2004. PricewaterhouseCoopers LLP examined the consolidated financial statements of the Company for the fiscal year ended December 31, 2003. The affirmative vote of a majority of the shares represented at the meeting is required for the ratification of the Board’s selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending December 31, 2004.

The Board of Directors recommends that shareholders vote “FOR” the ratification of the selection of PricewaterhouseCoopers LLP as independent auditors of the Company.

INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors is recommending that the shareholders approve PricewaterhouseCoopers LLP, as the independent auditors for the Company for the fiscal year ending August 31, 2004. PricewaterhouseCoopers LLC has served as the Company’s independent auditors since July 7, 2003. The Company does not expect representatives of PricewaterhouseCoopers LLC to be present at the Annual Meeting.

The Company engaged PricewaterhouseCoopers LLC following the resignation of BDO International as the Company’s independent auditors, effective July 3, 2003. The reports of BDO International on our financial statements for the two fiscal years ended December 31, 2002 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principle.

Our Board of Directors approved the resignation of BDO International.

In connection with its audits for the two fiscal years ended December 31, 2002 and during the subsequent interim period from January 1, 2003 through and including July 3, 2003, there were no disagreements with BDO International on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to the satisfaction of BDO International would have caused them to make reference thereto in their report on the financial statements for such years or interim period.

We requested BDO International furnish a letter addressed to the Securities and Exchange Commission stating whether or not BDO International agrees with the statements made above and, if not, stating the respects in which it does not agree. A copy of this letter, dated July 8, 2003, is incorporated by reference to our Current Report on Form 8-K filed with the SEC on April 10, 2003.

The aggregate audit fees for 2003 were approximately $57,054. The amounts include fees for professional services rendered by PricewaterhouseCoopers LLP in connection with the audit of our consolidated financial statements as of and for the fiscal year ended December 31, 2003 and reviews of our unaudited consolidated interim financial statements for the second and third quarters of year 2003.

7

The aggregate audit fees for 2002 were approximately $65,500. The amounts include fees for professional services rendered by BDO International in connection with the audit of our consolidated financial statements for the fiscal years ended December 31, 2002 and reviews of our unaudited consolidated interim financial statements for the first quarter of year 2003. In addition, BDO International also reviewed our unaudited consolidated interim financial statements for the first quarter of 2003. The aggregate audit fee for the first quarter of 2003 was approximately $21,500.

| |

| | |

Name (a) | | Fees Earned or Paid in Cash ($) (b) | | Stock Awards ($) (c) | | Option Awards ($) (d) | | Non-Equity Incentive Plan Compensation ($) (e) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (f) | | All Other Compensation ($) (g) | | Total ($) (j) | |

| Ming-Tsung Shih | | $ | 615 | | | - | | | - | | | - | | | - | | | - | | $ | 615 | |

| Robert Theng | | $ | 615 | | | - | | | - | | | - | | | - | | | - | | $ | 615 | |

There were no audit-related fees billed by PricewaterhouseCoopers LLP and BDO International for other services rendered to the Company for the fiscal years ended December 31, 2003 and 2002.

The aggregate fees for tax services rendered by PricewaterhouseCoopers LLP for 2003 was approximately $6,388. Tax fees relate to tax compliance and advisory services and assistance with tax audits. There was no tax fees billed by BDO International for the fiscal year ended December 31, 2002.

The aggregate fees for the Company’s ROC GAAP report services rendered by PricewaterhouseCoopers LLP was approximately $8,711.

There were no additional aggregate fees billed by PricewaterhouseCoopers LLP and BDO International for other services rendered to the Company for the fiscal years ended December 31, 2003 and 2002.

The Company’s Board of Directors did not establish an Audit Committee until April 2004 and therefore none of the services for 2003 described above were separately approved by the Audit Committee.

SECTION 16(A) BENEFICIAL OWNERSHIP COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our officers, directors and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and ten percent stockholders are required by regulation to furnish us with copies of all Section 16(a) forms they file. To the best of our knowledge (based solely upon a review of the Forms 3, 4 and 5 filed), during 2003, no individual or entity was late with any Form 3, 4 or 5 filings, except Ms. Chin-Chen Huang, who filed her Form 5 on April 22, 2004 in connection with the acquisition of 5,000 shares of the Company’s common stock in 2003.

8

CODE OF ETHICS

We

have adopted a corporate code of

ethics for management personnel on April 21, 2004. A copy of the code of ethics is filed as Appendix A to this Proxy Statement.ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code.

A copy of our corporate code of ethics may be obtained, without charge, upon written request to: HR Department, Mrs. Erica Lu, Kid Castle Educational Corporation, 8th Floor, No. 98 Min Chuan Road, Hsien Tien, Taipei, Taiwan ROC, Taipei, Taiwan.

PROPOSAL 2.RATIFICATION OF SELECTION OF AUDITORS

The Board of Directors requests that the shareholders ratify its selection of Brock, Schechter & Polakoff, LLP, independent auditors, to examine the consolidated financial statements of Kid Castle for the fiscal year ending December 31, 2005 and 2006. Price Waterhouse Coopers LLP examined the consolidated financial statements of the Company for the fiscal year ended December 31, 2004. The affirmative vote of a majority of the shares represented at the meeting is required for the ratification of the Board’s selection of Brock, Schechter & Polakoff, LLP as the Company’s independent auditors for the fiscal years ending December 31, 2005, and December 31, 2006.

On August 14, 2006, the relationship of the Company with its independent registered public accounting firm, Robert G. Jeffrey, Certified Public Accountant, of Wayne, New Jersey (“Jeffrey”), was terminated by mutual agreement. Jeffrey was the Company’s accounting firm during the time when financial statements were filed on Form 10-Q for the periods ended June 30, 2005 and September 30, 2005.

During the period from July 11, 2005, the date on which Jeffrey was retained as the independent registered public accountant for Kid Castle, through August 14, 2006 , there were no disagreements with Jeffrey on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of Jeffrey, would have caused it to make reference thereto in its reports on the financial statements for such years. During the period that Jeffrey served as the Company’s independent accountant, he advised the Company that it should restate its financial statements for the second and third quarters of 2005, due to the discovery of the fund withdrawals by the Company’s previous CFO, Yu-En Chiu. Chiu’s withdrawals and the Company’s action with respect thereto are more fully described in the Company’s Form 8-K dated June 23, 2006. The Company agreed with Jeffery that it should restate its 2005 second and third quarter financial statements.

On July 28, 2006, we engaged Brock, Schechter & Polakoff, LLP, as our principal accountant, to audit our consolidated financial statements for the year ending December 31, 2005. During the years ended December 31, 2005 and 2004, and through July 28, 2006, neither we (nor anyone on our behalf) consulted Brock, Schechter & Polakoff regarding: (i) either: the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on our financial statements, and neither a written nor oral report was provided to us in which a conclusion reached by the new accountant was an important factor considered by us in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a “disagreement” or a “reportable event” within the meaning of Item 304 of Regulation S-K .

Our principal accountant will be in attendance at the Annual General Meeting to be held on ●, 2007. Subject to time restrictions, representative of Brock, Schechter & Polakoff, LLP will be available for questions on the day of the meeting.

The Board of Directors recommends that shareholders vote “FOR” the ratification of the selection of Brock, Schechter & Polakoff, LLP as independent auditors of the Company.

Fees Paid to Independent Public Accountants for 2006 and 2005

Audit Fees . The total audit fees incurred for years 2005 and 2006 amounted to US$69,264 and US$136,325, respectively.

Audit-Related Fees . No audit-related fees were incurred in 2005 or 2006.

Tax Fees. The fees incurred for engaging tax advisors for years 2005 and 2006 amounted to US$13,000 for each period.

All Other Fees. None

Policy on Board of Directors Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Board of Directors pre-approves all audit and non-audit services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services. The Company’s independent auditors may be engaged to provide non-audit services only after the appointed Auditor has first considered the proposed engagement and has determined in each instance that the proposed services are not prohibited by applicable regulations and the auditors’ independence will not be materially impaired as a result of having provided these services. In making this determination, the Board of Directors take into consideration whether a reasonable investor, knowing all relevant facts and circumstances, would conclude that the Directors’ exercise of objective and impartial judgment on all issues encompassed within the auditors’ engagement would be materially impaired. PROPOSAL 3.AMENDMENT AND RESTATEMENT OF ARTICLES OF INCORPORATION INCREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 25,000,000 SHARES TO 50,000,000 SHARES AND CREATING A CLASS OF “BLANK CHECK” PREFERRED STOCK CONSISTING OF 10,000,000 SHARES.

Our authorized capital currently consists of 25,000,000 shares of common stock. As of ●, 2007, we had 25,000,000 shares of common stock issued and outstanding.

Pursuant to the amendment and restatement we will:

| · | increase the total number of authorized shares of our common stock to 50,000,000 shares, and |

| | |

| | create a class of “blank check” preferred stock, no par value per share, consisting of 10,000,000 shares. |

The text of our Amended and Restated Articles of Incorporation are attached to this information statement as Appendix A. The term “blank check” preferred stock refers to stock for which the designations, preferences, conversion rights, and cumulative, relative, participating, optional or other rights, including voting rights, qualifications, limitations or restrictions thereof, are determined by the Board of Directors of a company. As such, our Board of Directors will be entitled to authorize the creation and issuance of up to 10,000,000 shares of preferred stock in one or more series with such limitations and restrictions as may be determined in the sole discretion of our Board of Directors with no further authorization by shareholders required for the creation and issuance of the preferred stock. Any preferred stock issued would have priority over the common stock upon liquidation and might have priority rights as to dividends, voting and other features. Accordingly, the issuance of preferred stock could decrease the amount of earnings and assets allocable to or available for distribution to holders of common stock and adversely affect the rights and powers, including voting rights, of the common stock.

The Increase in Authorized Common Stock

Pursuant to the Amended and Restated Articles of Incorporation, we plan to increase the number of authorized shares of our common stock to 50,000,000 shares from 25,000,000 shares. Currently, all of the authorized shares of the Company’s common stock are issued and outstanding leaving the Company with no ability to issue additional shares for any reason. The Board of Directors has determined that it is in the best interest of the Company to increase the number of authorized shares to ensure that the Company has the flexibility to pursue future opportunities, including public or private offerings of shares for cash, acquisitions of other companies, pursuit of financing opportunities and other valid corporate purposes. However, the Company currently has no plans to pursue any specific acquisitions, issuances in connection with public or private offerings for cash, or other financing activities or to issue any of the shares should they be authorized. The Board of Directors has discussed implementing an employee stock option plan, but currently has no definitive plans to do so. None of the Company’s directors or executive officers has a personal or financial interest in increasing the number of authorized shares of common stock.

The holders of our common stock are entitled to one vote for each share held of record on all matters to be voted on by shareholders. The holders of our common stock are entitled to receive such dividends, if any, as may be declared from time to time by our Board of Directors, in its discretion, from funds legally available therefor. Upon liquidation or dissolution of the Company, the holders of our common stock are entitled to receive, pro rata, assets remaining available for distribution to shareholders. Our common stock has no cumulative voting, preemptive or subscription rights and is not subject to any future calls. There are no conversion rights or redemption or sinking fund provisions applicable to the shares of our common stock. All the outstanding shares of our common stock are fully paid and nonassessable.

Although the increase in the authorized number of shares of common stock will not, in and of itself, have any immediate effect on the rights of our shareholders, any future issuance of additional shares of common stock could affect our shareholders in a number of respects, including by diluting the voting power of the current holders of our common stock and by diluting the earnings per share and book value per share of outstanding shares of our common stock at such time. In addition, the issuance of additional shares of common stock or shares of preferred stock that are convertible into common stock could adversely affect the market price of our common stock. Moreover, if we issue securities convertible into common stock or other securities that have rights, preferences and privileges senior to those of our common stock, the holders of our common stock may suffer significant dilution. Our Board of Directors believes that it is in the best interest of the Company and our shareholders to have additional shares of common stock authorized and available for issuance or reservation on an as-needed basis without the delay or expense of seeking shareholder approval (unless required by law). The Board of Directors believes that it is in the best interests the Company and its shareholders to have the flexibility to raise additional capital or to pursue acquisitions to support our business plan, including the ability to authorize and issue preferred stock having terms and conditions satisfactory to investors or to acquisition candidates, including preferred stock.,

The proposed increase in the authorized number of shares of common stock could have a number of effects on the Company’s stockholders depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. The increase could have an anti-takeover effect, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the Company more difficult. For example, additional shares could be issued by the Company so as to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company, including instances where the independent shareholders of the Company favor a transaction paying an above-market premium for shares of the Company’s stock. Similarly, the issuance of additional shares to certain persons allied with the Company’s management could have the effect of making it more difficult to remove the Company’s current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti- takeover device.

The Authorization of “Blank Check” Preferred Stock

The term “blank check” preferred stock refers to stock for which the designations, preferences, conversion rights, and cumulative, relative, participating, optional or other rights, including voting rights, qualifications, limitations or restrictions thereof, are determined by the Board of Directors of a company. As a result of the adoption of the Amended and Restated Articles of Incorporation, our Board of Directors will be entitled to authorize the creation and issuance of up to 10,000,000 shares of preferred stock in one or more series with such limitations and restrictions as may be determined in the sole discretion of the Board of Directors, with no further authorization by shareholders required for the creation and issuance of the preferred stock. Any preferred stock issued would have priority over the common stock upon liquidation and might have priority rights as to dividends, voting and other features. Accordingly, the issuance of preferred stock could decrease the amount of earnings and assets allocable to or available for distribution to holders of common stock and adversely affect the rights and powers, including voting rights, of the common stock.

The Board of Directors believes that the creation of the preferred stock is in the best interests of the Company and its shareholders and it believes it advisable to authorize such shares to have them available for, among other things, possible issuance in connection with such activities as public or private offerings of shares for cash, acquisitions of other companies, pursuit of financing opportunities and other valid corporate purposes. The Board of Directors further believes that the ability to issue preferred stock may enable the Company to pursue a broader spectrum of financing and growth opportunities than would otherwise be not available to it should it continue to issue only common stock. The Company has no current plans to issue preferred stock, should it be authorized, nor does the Company have any current plans to pursue any specific opportunities requiring the issuance of preferred shares. None of the Company’s directors or executive officers has a personal or financial interest in the issuance of “Blank Check” Preferred Stock. No other provision of the Company’s governing documents has a material anti-takeover effect and the company does not currently have any plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

In approving the Amended and Restated Articles of Incorporation, the Board of Directors considered the following positive factors. The “blank check” preferred stock will provide our Board of Directors with the ability to create preferred shares without a shareholder vote and provide greater financial flexibility and speed at a lower cost, thereby increasing our ability to secure capital or close acquisitions which may benefit the growth of our Company and may help us to increase our revenues and profits. There is a considerable possibility that amending the Company’s Articles of Incorporation to provide for “blank check” preferred stock will not help increase revenues and profits. Nevertheless, the Board of Directors has given great weight to the factors of increased flexibility and speed and lower costs because of the potential benefits to our Company. For example:

| · | The availability of “blank check” preferred stock will permit our Board of Directors to negotiate the precise terms of an equity instrument by simply creating a new series of preferred stock at will without incurring the costs and delay in obtaining prior shareholder approval. This may permit our Company to more effectively negotiate with, and to satisfy the financial criteria of, an investor or a transaction in a timely manner; and |

| · | Dividend or interest rates, conversion rates, voting rights, liquidation preferences, terms of redemption (including sinking fund provisions), redemption prices, preemptive rights, maturity dates and similar characteristics of a series of preferred stock could be determined by our Board of Directors without obtaining prior shareholder approval, thus reducing the time and costs involved in consummating a transaction. |

Our Board of Directors also considered significant negative factors which weighed against the adoption of the “blank check” preferred stock. The negative implications of the authorization of “blank check” preferred stock include the following:

| · | The issuance and designation of any shares of “blank check” preferred stock may result in a dilution of the voting power and equity interests in Kid Castle of our current shareholders; and |

| · | Any other future issuance of “blank check” preferred stock may prevent an acquisition of Kid Castle by any outsider, as well as make it more difficult for our shareholders to remove incumbent managers and directors. |

Our shareholders will be solely reliant upon the business judgment of our Board of Directors regarding the various terms and conditions which may be ascribed to any series of preferred stock created in the future. Moreover, the ability to designate and issue new series of “blank check” preferred stock without shareholder action deprives shareholders of notice that such actions are being considered and of providing input in the process. As a result, preferred stock could be issued quickly and easily, could adversely affect the rights of holders of common stock and could be issued with terms calculated to delay or prevent a change in control, including instances where the independent shareholders of the Company favor a transaction paying an above-market premium for shares of the Company’s stock, or to make removal of management more difficult and thus could be viewed as having an anti-takeover effect. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti- takeover device.

The Board of Directors gave some weight to potential shareholder dilution, but determined that these factors were well outweighed by the potential benefits of flexibility, speed and cost. Notwithstanding the potential dilution to our common shareholders in voting powers and equity investments, our Board of Directors believes that if it can grow our Company’s revenues and earnings, this growth may be reflected in the trading price of our common stock and the market liquidity of the securities, both of which will benefit our public shareholders. As of ●, 2007, the last reported trade price of our common stock as reported on the Pink Sheets was $0.20 per share. Our stock is thinly traded.

Other than the authorization of shares of preferred stock, we do not currently have any plans, commitments, arrangements or agreements, written or otherwise, to issue or designate any of the “blank check” preferred stock to be authorized by the amendment and restatement, nor can we assure our shareholders that the market price of our common stock will rise in the future.

The full text of the Amended and Restated Articles of Incorporation are attached to this Proxy Statement as Appendix A.

The Board of Directors recommends that shareholders for “FOR” approval of the Amended and Restated Articles of Incorporation.

PROPOSALS OF SHAREHOLDERS

We expect to hold our next annual meeting on or about June 30, 2008. Shareholder proposals that are (a) intended for inclusion in next year’s proxy statement or (b) to be presented at next year’s Annual Meeting without inclusion in the Company’s proxy materials, must be directed to the Corporate Secretary at the Company, 8th Floor, No. 98 Min Chuan Road, Hsien Tien, Taipei, Taiwan

R.O.C.ROC, Taipei, Taiwan, and must be received

at the Company by

April 15, 2005.5:00 pm February 28, 2008. Any shareholder proposal for next year’s Annual Meeting submitted after

April 15, 20055.00 pm February 28, 2008 will not be considered filed on a timely basis with the Company. For proposals that are timely filed, the Company retains discretion to vote proxies it receives provided (1) the Company includes in its proxy statement advice on the nature of the proposal and how it intends to exercise its voting discretion; and (2) the proponent does not issue a proxy statement.

It is not intended by the Board of Directors to bring any other business before the meeting, and so far as is known to the Board, no matters are to be brought before the meeting except as specified in the notice of the meeting. However, as to any other business which may properly come before the meeting, it is intended that proxies, in the form enclosed, will be voted in respect thereof, in accordance with the judgment of the persons voting such proxies.

| KID CASTLE EDUCATIONAL CORPORATION |

| | KID CASTLE EDUCATIONAL CORPORATION |

| | By Order of the Board of Directors |

| |

| | /s/ YU-EN CHIU |

| |

|

| | Yu-En ChiuMin-Tan Yang |

| | SecretaryChief Executive Officer and Director |

Taipei, Taiwan

April 30, 2004●, 2007

9

INCORPORATION BY REFERENCE AND AVAILABILITY OF ANNUAL REPORT AVAILABLEON FORM 10-K

The information contained in our Annual Report on Form 10-K filed with the Security and Exchange Commission on June 14, 2007 is incorporated by reference herein.

A copy of the Company’s annual report on Form

10-KSB,10-K, as filed with the Securities and Exchange Commission, will be available to the public over the Internet at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms.

10

APPENDIX A

KID CASTLE EDUCATIONAL CORPORATION

CODE OF ETHICS

FOR

MANAGEMENT PERSONNEL, INCLUDINGSENIOR FINANCIAL OFFICERS-16-

Introduction.

This Code of Ethics for management personnel, including Senior Financial Officers, has been adopted by the Board of Directors of Kid Castle Educational Corporation to promote honest and ethical conduct, proper disclosure of financial information in the Company periodic reports, and compliance with applicable laws, rules, and regulations by the Company officers and management personnel. It is an integral part of the Company Standards of Conduct applicable to the Company employees generally, but is set out in this special Code of Ethics because of the importance of the topic.

Applicability.

As used in this Code, the term Senior Financial Officer means the Company Chief Executive Officer, Chief Financial Officer and Controller.

Principles and Practices.

In performing his or her duties, each of the management personnel, including Senior Financial Officers, must:

| |

| (1) conduct him or herself in an honest and ethical manner and avoid any actual or apparent conflict of interest as defined in the Company Standards of Business Conduct; |

|

| (2) in the case of the Senior Financial Officers, report to the Audit Committee of the Board any conflict of interest that may arise, and any transaction or relationship that reasonably could be expected to five rise to a conflict, and in the case of all others, to senior management; |

|

| (3) provide, or cause to be provided, full, fair, accurate, timely, and understandable disclosure in reports and documents that the Company files with or submits to the Securities and Exchange Commission and in its other public communications; |

|

| (4) comply, and take all reasonable actions to cause others to comply, with applicable governmental laws, rules, and regulations; and |

|

| (5) in the case of the Senior Financial Officers, promptly report violations of this Code to the Audit Committee, and in the case of all others, to senior management. |

Waiver.

Any request for a waiver of any provision of this Code by or on behalf of any Senior Financial Officer must be in writing and addressed to the Audit Committee. Any waiver of this Code by or on behalf of any Senior Financial Officer will be disclosed promptly on Form 8-K or any other means approved by the Securities and Exchange Commission.

Compliance and Accountability.

The Audit Committee will assess compliance with this Code, report material violations to the Board of Directors, and recommend to the Board appropriate action.

Approved by the Board of Directors

On April 21, 2004

A-1

APPENDIX B

B-1

[FRONT]

FOR ANNUAL MEETING OF THE SHAREHOLDERS

KID CASTLE EDUCATIONAL CORPORATION

This Proxyproxy is Solicitedsolicited on Behalfbehalf of the Board of Directors

The undersigned hereby appoints

Kuo-An WangMin-Tan Yang and

Yu-En ChiuSuang-Yi Pai (collectively, the “Proxies”), and each of them, with full power of substitution, as proxies to vote the shares which the undersigned is entitled to vote at the Annual Meeting of the Company to be held at

9th Floor Building 1, Huasheng Building, 519 Lane Aomen Road, Putuo District, Shanghai,9.00 am (local time) on

Monday, May 17, 2004●, ●, 2007 at

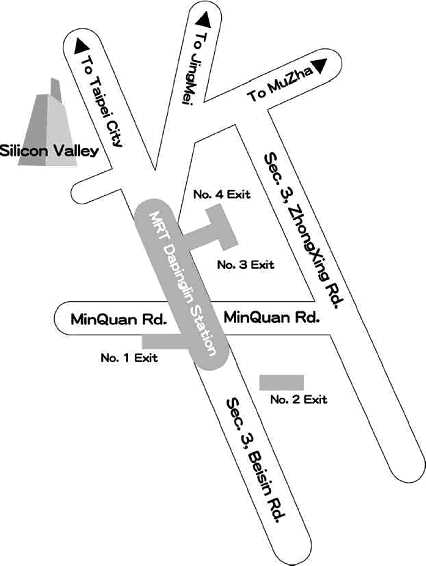

10:00 a.m. (local time)Taipei Silicon Valley International Assembly Hall, B1, No. 207, Sec. 3, Beisin Rd., Hsien Tien City, Taipei County, Taiwan, ROC and at any adjournments thereof.

| |

PROPOSAL 1 - ELECTION OF DIRECTORS

FOR Election of directors: Min-Tan Yang, Suang-Yi Pai, Chin-Chen Huang, Ming-Tsung Shih and Robert Theng

o 1. FOR Election of directors: o | Kuo-An Wang, Yu-En Chiu, Suang-Yi Pai,

Chin-Chen Huang, Yu-Fang Lin, Ming-Tsung Shih, Yuanchan Liour and Robert Theng |

WITHHOLD AUTHORITY Toto Vote for the following Directors: _________________________________

o ABSTAIN

PROPOSAL 2 - APPROVE AUDITORS

o FOR o AGAINST o ABSTAIN Proposal to ratify the selection of Brock, Schechter & Polakoff, LLP as the Company’s independent auditors for the fiscal year ending December 31, 2005 and 2006.

PROPOSAL 3 - INCREASE AUTHORIZED STOCK, APPROVE BLANK CHECK PREFERRED STOCK

OTHER MATTERS

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

| |

2. | o FOR o AGAINST o ABSTAIN Proposal to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending December 31, 2004. |

|

3. | In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting. |

[REVERSE]

|

Signature

Signature, if held jointlyDated: ____________________ |

| |

|

| Signature |

| |

| |

|

| | Signature, if held jointly |

|

| Dated:

, 2004 |

|

| IMPORTANT —- PLEASE SIGN AND RETURN PROMPTLY. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee, or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by an authorized person. |

APPENDIX A

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

KID CASTLE EDUCATIONAL CORPORATION

ARTICLE I

The name of this corporation shall be: “Kid Castle Educational Corporation”.

ARTICLE II

The corporation is organized for the following purposes:

(a) To conduct any type of business which is lawful under the laws of the State of Florida.

(b) To carry on business in the United States or elsewhere as factors, agents, commission merchants or merchants to buy, sell, manipulate and deal in, at wholesale or retail, merchandise, goods, wares, products and commodities of every sort, kind or description; to open stores, offices or agencies throughout the United States or elsewhere; to purchase or otherwise acquire and undertake all or any part of the business property and liabilities of any persons or companies; to enter into partnership or into any arrangements for sharing profits, union interests, reciprocal concessions, or cooperate with any persons or companies; to transact any and all business lawful under the laws of the State of Florida or of the United States of America.

ARTICLE III

(a) The total number of shares which the corporation is authorized to issue is 60,000,000, consisting of 50,000,000 shares of common stock, without par value, and 10,000,000 shares of preferred stock, without par value. The common stock is subject to the rights and preferences of the preferred stock as set forth below.

(b) The preferred stock may be issued from time to time in one or more series in any manner permitted by law and the provisions of these Articles of Incorporation, as determined from time to time by the Board of Directors and stated in the resolution or resolutions providing for its issuance, prior to the issuance of any shares. The Board of Directors shall have the authority to fix and determine and to amend, subject to these provisions, the designation, preferences, limitations and relative rights of the shares of any series that is wholly unissued or to be established. Unless otherwise specifically provided in the resolution establishing any series, the Board of Directors shall further have the authority, after the issuance of shares of a series whose number it has designated, to amend the resolution establishing such series to decrease the number of shares of that series, but not below the number of shares of such series then outstanding.

ARTICLE IV